Litigation Finance 101

Insights  John J. Hanley · December 18, 2020

John J. Hanley · December 18, 2020

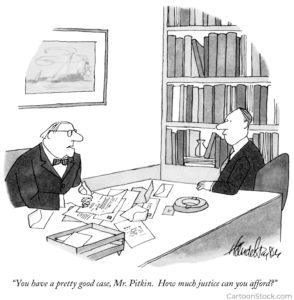

You are the CEO of a thriving technology company. Your chief legal officer informs you that a well-heeled vender has stolen components of the intellectual property that is your company’s lifeblood. However, litigation is expensive and the thief is prepared to engage in a costly war of attrition intended to exhaust and overwhelm your business and the company’s resources are tied up in R&D. What can be done? Litigation finance, sometimes called litigation funding, may be the answer.

What is Litigation Finance?

At a basic level, litigation finance is when a third party, unrelated to the lawsuit, provides money to a plaintiff or claimant to further that party’s objective in the legal claim for a financial reward on a non-recourse basis. That is, if the plaintiff or claimant loses the case, nothing is owed to the litigation funder. The litigation funder receives a portion of any financial recovery from the underlying lawsuit. It’s a no-win-no-fee arrangement. The capital provided by monetizing a legal claim is often directly applied to the costs of litigation, including attorneys’ fees, investigative fees, expert witness fees and court expenses. A litigation finance transaction is not classified as a loan because it is non-recourse. The funder only receives a payout if the case is won, or if a settlement is reached.

Who Uses Litigation Finance?

Fortune-500 companies (and businesses of all sizes as well as universities and others) have taken advantage of the benefits of litigation finance. According to Norton Rose Fulbright, 90% of U.S. corporations are engaged in litigation at any one time. Under certain circumstances, generally accepted accounting principles require an enterprise to accrue an expense and usually record a corresponding liability for various loss contingencies, including pending lawsuits. It therefore makes sense for publicly traded firms – even cash-rich, Fortune-500 ones – to outsource the costs of their litigation. That way, no capital gets lost on the balance sheet while the litigation is pending.

Some key features of a typical litigation finance agreement:

- The plaintiff or claimant receiving funding may use the capital to pay fees and expenses associated with a case or for an entirely different business purpose.

- The plaintiff maintains control over the case and the financier is a passive outside investor.

- The litigation financier does not have rights to control settlement of the litigation.

- Courts have consistently confirmed that work product shared with a financier under a confidentiality agreement remains privileged.

Some Additional Benefits of Litigation Finance:

- Litigation finance levels the financial playing field by providing enterprises of all sizes with the capital needed to redress wrongs.

- Litigation finance reduces the risk of a premature settlement since users gain the advantage of time when entering any litigation. Plaintiffs can reject low-ball settlement offers and negotiate a much more equitable payout.

Litigation finance can be a wonderful tool in the litigant’s toolbelt. Our litigation finance practice covers all areas, including commercial torts, breaches of contract, mass torts, patent infringement, antitrust and appraisal rights. We negotiate, structure and draft litigation financing solutions for claimants and financiers for litigation on a non-recourse basis from inception through appeal and enforcement.

John J. Hanley focuses his practice on litigation finance, first and second lien financings; private placements of debt and equity securities; and the purchase and sale of loans, securities, trade claims, and other illiquid assets. His clients include litigation funders, claimants, business development companies, specialty lenders, investment banks, hedge funds, actively managed CLOs, special purpose vehicles, and other financial institutions. Read more.

Attorney Advertising. This document is not intended to be and is not considered to be legal advice. Transmission of this document is not intended to create, and receipt does not establish an attorney-client relationship. Prior results do not guarantee a similar outcome.