US Debt and Equity Offers by Australian and New Zealand Issuers in 2023

Insights  Andrew Reilly · February 13, 2024

Andrew Reilly · February 13, 2024

A significant number of Australian and New Zealand issuers accessed the US capital markets in 2023. We have identified 128 US debt and equity offers that were completed by Australian and New Zealand issuers in 2023, with a median amount raised of A$100 million.

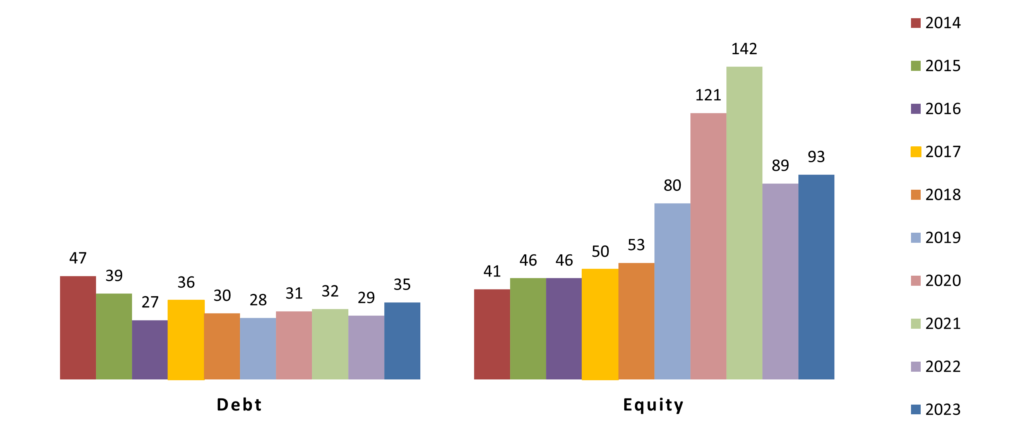

The following graph shows the number of debt and equity offers completed by Australian and New Zealand issuers in the United States over the past ten years:

As interest rates began to stabilize and market conditions improved in 2023, the number of debt offers increased significantly and equity offers increased slightly from 2022.

As interest rates began to stabilize and market conditions improved in 2023, the number of debt offers increased significantly and equity offers increased slightly from 2022.

The number of US debt deals increased 21% in 2023 from 2022, with the number of US Private Placements increasing from 13 in 2022 to 17 in 2023. While the number of SEC-registered and Rule 144A investment-grade bond offers remained relatively constant in 2023 (with the majority of transactions for financial institutions), the number of high yield bond offers doubled from 1 in 2022 to 2 in 2023.

The total number of US equity raisings increased 4% from 89 in 2022 to 93 in 2023. The number of Australian IPOs that included a US tranche fell from 4 in 2022 to 2 in 2023, with each of them having a small US tranche. The number of ‘low doc’ offers increased slightly from 82 in 2022 to 83 in 2023 while the number of follow-on capital raisings with a formal offer document increased from nil in 2022 to 5 in 2023. The number of SEC-registered equity offers remained constant at 3 in 2023, including 2 ‘at the market’ programs.

While the number of Australian companies listed on a US stock exchange remained relatively constant in 2023, we advised one Australian company (Incannex Healthcare) on its re-domiciliation to become a Delaware corporation in 2023 with a listing solely on Nasdaq. In addition, three other dual listed Australian companies simply delisted from ASX in 2023 and now maintain a sole listing of American Depositary Shares on Nasdaq.

Other offshore equity markets continue to be important. Based upon our work as International Counsel, almost 300 Australian and New Zealand issuers tapped Asian, Canadian and European institutional equity investors in 2023.

Click here to download a chart that lists the US debt and equity offers completed by Australian and New Zealand issuers in 2023.

Over the past 25 years, Andrew Reilly has represented Australian and New Zealand companies on more than 2,000 offers of debt and equity securities in the United States. He also advises underwriters and placement agents ranging from boutique to “bulge bracket” investment banks. Andrew’s practice focuses on US securities and corporate law matters. He advises on private placements, Rule 144A transactions and US public offers of debt and equity securities, including Nasdaq listings. He also advises on re-domiciliation of Australian companies to Delaware, commercial matters, bank finance and cross-border M&A transactions. Read more here.